Effective financial planning is the foundation of business success. This guide covers essential financial planning strategies for small and medium businesses.

Create a Comprehensive Budget

Develop a detailed budget that includes all revenue sources and expenses. Review and update it regularly to reflect changing business conditions.

Manage Cash Flow

Cash flow management is critical for business survival. Monitor cash flow closely, forecast future needs, and maintain adequate reserves.

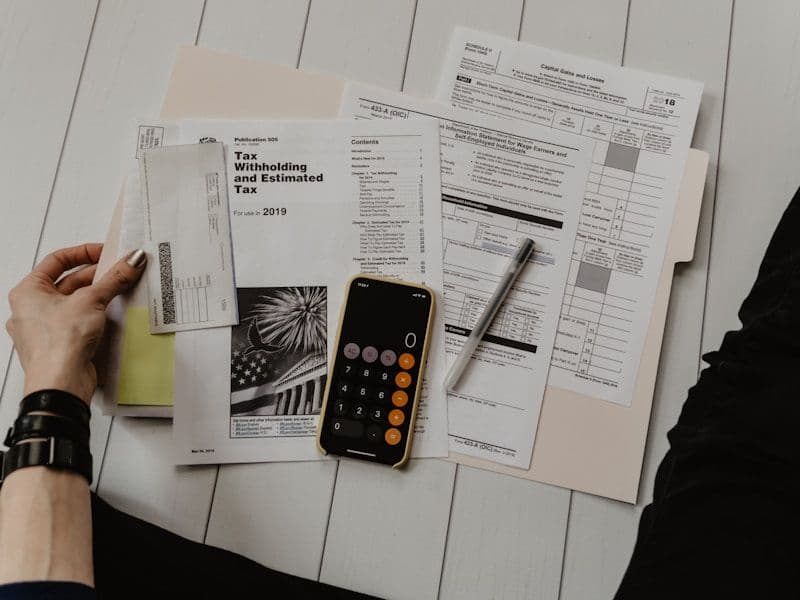

Plan for Taxes

Proper tax planning can save significant money. Work with a tax professional to understand deductions, credits, and planning strategies.

Invest in Growth

Allocate resources strategically for growth initiatives. Balance current needs with long-term investment requirements.

Monitor Key Metrics

Track important financial metrics like profit margins, return on investment, and debt-to-equity ratios to gauge business health.

With proper financial planning, small businesses can navigate challenges and position themselves for sustainable growth.