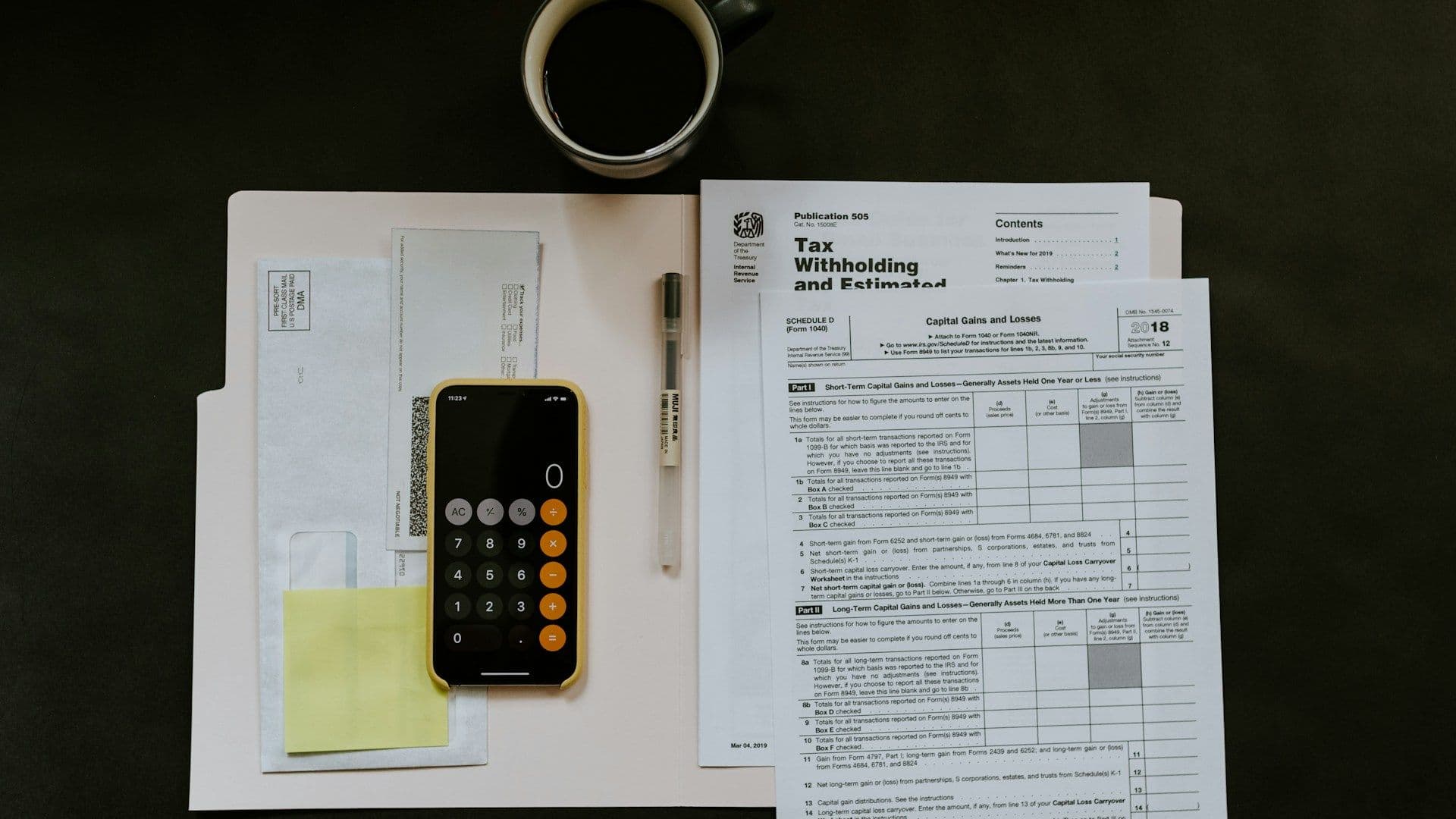

Scale Your Tax Practice Without Overhead

Our tax preparers are credentialed professionals (CPAs, EAs, CAs) who work exclusively on US tax returns and are updated annually on IRS tax code changes.

Credentialed Pros

IRS Compliant

Choose Your Perfect Match

From junior associates to senior managers, we have professionals at every experience level to match your specific needs and budget.

Associate Tax Preparer

6 months - 2 years

Core Responsibilities

- Tax Indexing: Sorting and bookmarking digital tax organizers into standardized PDF workpapers

- Basic Form 1040: Entering data for simple individual returns (W-2, Interest, and Dividends)

- Drafting Workpapers: Creating lead schedules for simple Schedule C (Sole Proprietor) businesses

- Pro-forma Migration: Rolling forward previous year data into the current year software

- Document Organization: Managing and organizing tax source documents with proper indexing

Senior Tax Associate

2-5 years

Core Responsibilities

- Entity Returns: Preparing Form 1065 (Partnerships) and Form 1120S (S-Corps)

- Book-to-Tax (M-1): Calculating adjustments between financial net income and taxable income

- Depreciation Logic: Calculating MACRS, Section 179, and Bonus Depreciation for business assets

- Sales Tax Compliance: Managing multi-state nexus studies and filing via TaxJar or Avalara

- Complex Schedules: Preparing Schedule E (Rental Properties), Schedule D (Capital Gains), Schedule C (Business)

- State Tax Returns: Preparing multi-state individual and business tax returns

Tax Manager / Specialist

5+ years

Core Responsibilities

- International Compliance: Preparing high-penalty forms like 5471 (CFCs) and 5472 (Foreign-owned US corps)

- Advanced Form 1040: Handling High-Net-Worth individuals with complex Schedule E (Rentals) and multi-state K-1s

- Notice Resolution: Drafting formal responses to IRS and State tax notices

- Estate & Trust: Preparing Form 1041 (Fiduciary) and Form 706 (Estate/Gift Tax)

- Tax Planning: Providing strategic tax planning advice and optimization strategies

- Quality Review: Performing final quality reviews of complex returns prepared by junior staff

Seamless Integration

Our professionals are proficient in all major platforms and tools. No need to change your existing workflow.

Tax Preparation Software

Sales Tax Platforms

Document Management

Workflow Management

Getting Started

We follow a rigorous methodology to ensure your Hire Tax Preparation Staff transition is effortless and effective.

Needs Assessment

Discuss your volume, complexity level, and software requirements. We'll understand your firm's specific tax specialties and workflows.

Candidate Selection

Review 2-3 pre-vetted resumes with relevant experience levels, software proficiency, and tax specialties matching your needs.

Interview Process

Conduct video interviews to assess technical knowledge, communication skills, and cultural fit for your firm.

Onboarding & Training

We handle all infrastructure and compliance. You train them on your firm-specific procedures and quality standards.

Ongoing Quality Control

Continuous monitoring with our multi-tier review system ensures consistent accuracy in all tax filings.

The Hire Tax Preparation Staff

Advantage

Credentialed Professionals

Only CPA, Enrolled Agents (EA), and Chartered Accountants (CA) with verifiable credentials and US tax training.

Tax Season Scalability

Ramp up capacity from January-April, then scale down post-extension season without severance costs.

CPE Training Included

We cover all Continuing Professional Education (CPE) requirements at our expense, ensuring current knowledge.

PTIN Compliance

All preparers maintain valid IRS Preparer Tax Identification Numbers (PTINs) and Circular 230 ethics.

Multi-State Complexity

Handle resident, non-resident, and part-year state returns across all 50 states with confidence.

Driving performance through

strategic financial leadership.

Frequently Asked Questions

Detailed answers to the most common questions regarding our Hire Tax Preparation Staff services.