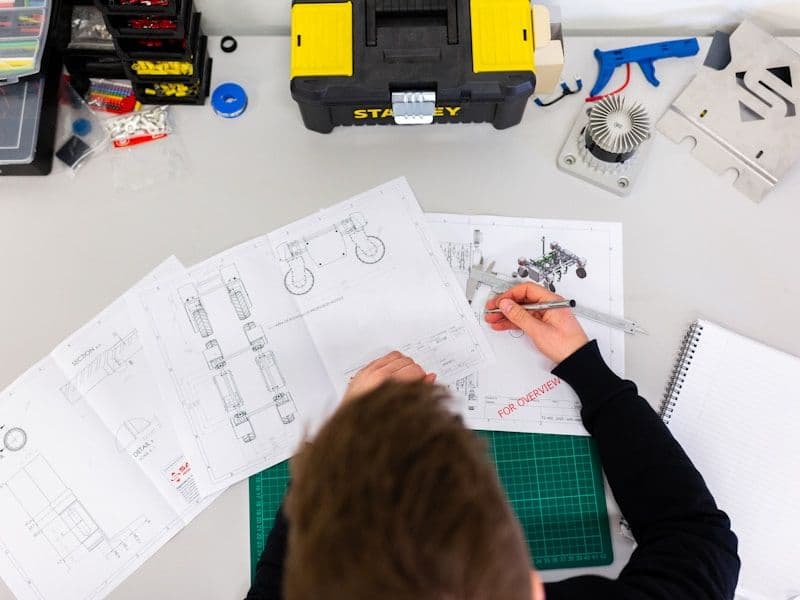

Precision for Complex Industries

From manufacturing cost accounting to specialized regulatory compliance, we bring deep expertise to industrial and niche market businesses.

Inventory Accy

Industries Served

Specialized Expertise

Comprehensive accounting, payroll, and tax services tailored to each sub-sector of Industrial & Niche.

📚Bookkeeping

- •Tracking Restricted vs. Unrestricted funds by donor and purpose

- •Recording donor contributions and pledges (temporarily and permanently restricted)

- •Managing accounts payable for program-specific expenses

- •Reconciling grant expenditures against budgets

🧮Accounting

- •Functional Expense Allocation (splitting costs between Program, Management, and Fundraising)

- •Preparing Statement of Functional Expenses (required for Form 990)

- •Monitoring grant spend-down rates to ensure compliance with funding requirements

- •Net asset classification and reporting

👥Payroll

- •Managing multi-funded payroll (splitting one employee's salary across three different grants)

- •Tracking volunteer hours for financial statement notes and grant reporting

- •Processing stipends for program participants

📄Tax Preparation

- •Preparation of IRS Form 990 / 990-EZ / 990-N (annual information return)

- •Managing UBIT (Unrelated Business Income Tax) if the NGO sells products/services

- •Maintaining tax-exempt status compliance

- •State charity registration renewals

⚙️Software Stack

Getting Started

We follow a rigorous methodology to ensure your Industrial & Niche transition is effortless and effective.

Industry Assessment

Review your specific regulatory requirements, compliance needs, and industry software.

Compliance Framework

Establish proper procedures for industry-specific filings and reporting.

Software Integration

Connect industry-specific platforms with accounting systems.

Custom Reporting

Build dashboards and reports tracking your industry's unique KPIs.

Ongoing Compliance Monitoring

Regular reviews ensuring all regulatory deadlines and requirements are met.

The Industrial & Niche

Advantage

Regulatory Expertise

Deep knowledge of industry-specific regulations including Section 280E (cannabis), IFTA (trucking), 263A (manufacturing), and Form 990 (non-profits).

Specialized Software Proficiency

Experience with niche industry platforms like Metrc (cannabis), TMS systems (logistics), BOM software (manufacturing), and donor management (non-profits).

Complex Compliance

Handle unique filing requirements like FBAR, FATCA, Schedule H (household employees), IC-DISC, and specialized state reporting.

Industry-Specific KPIs

Track metrics that matter for your industry—cost-per-mile (trucking), functional expense ratios (non-profits), 280E optimization (cannabis), or biological asset valuation (agriculture).

White-Glove Service

Understand that specialized industries require specialized attention—providing concierge-level service for family offices and complex compliance for regulated industries.

Driving performance through

strategic financial leadership.

Frequently Asked Questions

Detailed answers to the most common questions regarding our Industrial & Niche industrys.